The people have listened! We are finally fighting the revolution we need. No, I’m not referring to the capitol riots, that was moronic (see my take here). I’m talking about the average investor taking on Wall Street head to head. And so far, we’re winning.

The new age investors can all be found on a site called Reddit. Specifically, in an infamous subreddit named Wallstreetbets. This subreddit has been the topic of many conversations recently, mostly in a negative light. The old school investors believe the members do not know anything about investing and are simply gambling in the stock market. Admittedly, I have been a member of this forum since 2017 and I can say there are definitely gamblers on the site, but there are far more investors who are extremely intelligent, providing their research for the world to read. In the last year, the subreddit has gained nearly 2 million members and the research and information provided has only gotten better. You may have to sort through the memes and shit posts, but those insightful write-ups are there, you just need to find them.

Now, in case you missed it, the 2.9 million members of Wallstreetbets decided to fight back against the billionaire hedge funds who control the stock market. A few weeks ago, several of the savvy investors realized that GameStop shares were being heavily shorted by hedge funds, specially a fund named Melvin Capital.

Heavily shorted, what does that mean? Shorting a stock means you believe the stock is overvalued and the share price is going to go down. So heavily shorted means many people or institutions are currently shorting the stock. How can one short the stock? Well, it involves three parts. A brokerage, company where you buy and sell stocks, has shares of a company “X”. You, a person who believes company “X” is overvalued and wants to short the stock, borrow these shares from the brokerage. You do not pay any money up front, you simply have to pay interest over time. Very similar to a loan. You then turn around and sell the shares of company “X” to a third party, pocketing the dollar value of the shares. So, let’s say you borrow 100 shares and sell them to the third party at $20 per share. You would get $2,000 in your trading account. Whoa, I make money by selling shares of a company I never purchased? Well, you don’t get to keep it all, but you can keep a lot of the money if you are right about the share price going down. Let’s say company “X” shares fall to $5 per share. You decide it’s time to close or cover your short position. This just means you made money and are done with this trade, so you lock in your profits. You would simply buy 100 shares at the $5, costing you $500 from your trading account. You then return the shares back to the brokerage, pay the interest accrued, say $50 for easy calculations, and you get to keep the remaining $1,450. Sounds great, right? What could go wrong? Well, If the share price goes up, you will lose money. For instance, company “X” shares rise to $30 per share. You can take a risk and hope the price comes down, or you can close the short position. You would buy 100 shares, this time at $30 per share, costing you $3,000, which is $1,000 out of your pocket since you made $2,000 earlier when you opened the trade. You would then return the shares to the brokerage, with the interest owed, we’ll use $50 again, and you would have lost $1,050 in total. Now, when the price gets to $30, you can decide to keep the trade and hope the price goes down again. But you take the risk of the share price continuing to rise and you losing more money.

Now that you have a basic understanding of shorting, let’s get to the first act of war by WSB. Several weeks ago, members of the site posted their research and found that many hedge funds were shorting GameStop. Actually, the hedge funds were shorting over 130% of the outstanding shares of the company. Yes, more shares were shorted than even existed. Hedge funds borrowed and sold shares from their brokerages to other brokerages who then lent those shares to other hedge funds to further short. That should not even be possible, but market makers don’t have rules, they make the rules. Anyway, the brilliant minds of WSB saw a huge opportunity. They provided their due diligence (DD) to the forum and disclosed their positions. The other 2+ million members saw the opportunity and piled into the trade, purchasing shares and call options for GameStop. This began to drive the price up, which, as you now know, means those hedge funds began losing significant sums of money. And hedge funds, they don’t like losing money.

Wallstreetbets was able to drive the price of GameStop shares $18 to $35 early last week. At this point, the hedge funds had two choices, cover their shorts and accept the loss, or double down. A few institutions covered their shorts, leading to a small short squeeze. A short squeeze is basically multiple shorters getting out of their positions leading to a stock price rising very quickly. It’s sort of like a cascading effect. The first short seller covers, in turn pushing the share price higher. This causes another shorter to cover their trade to prevent losing more money. Again, this causes the share price to rise. This continues to happen until there are no more shorters left.

The short squeeze early last week took the price to $50 per share. Many hedge funds, however, chose not to cover their short and decided to double down, including Melvin Capital and the most infamous shorter in the stock market, Andrew Left from Citron Research. Mr. Left even went live on Twitter to call Wallstreetbets a bunch of delinquents and predicting share price would drop to $20. Wallstreetbets members did not take kindly to this and they continued to put the pressure on, purchasing shares and calls hand over fist. Members were posting screenshots of their accounts and their huge profits from trading GameStop. The winner by far was a user named DeepFuckingValue, whose gains were roughly five million dollars by the end of the week, when the stock was squeezed further up to $75 per share.

All of sudden, the “professionals” who have rigged the stock market and tilted the tables in their favor for DECADES, were losing to a bunch of money to regular investors. Regular investors playing by the same rules the professionals do. A stock should not be able to shorted the way GameStop was. But the rules allowed it, and WSB exposed it. Simple as that.

Naturally, these millionaires and billionaires went onto CNBC and began complaining about the subreddit. Saying that it was unfair, it was market manipulation, and even calling for the SEC to investigate the members. Some CNBC hosts and guests have even called on Congress to write new laws and regulations to prevent amateur investors from having the capability talk on a forum and trade on this information, leading to the White House "monitoring the situation".

Not only do we not have access to the same information these institutions have, but we don’t have access to high speed trading, or even have the ability to go on national television and pump whatever stocks they want. But now, they want to change the rules to give them more of an advantage?

Let me explain here. Hedge fund managers and billionaires have access to software, such as a Bloomberg Terminal, that provide information in real time before the rest of the world hears about it. They have algorithms that trade the market based on this information. When it comes to trading, every second counts. Retail investors do not have access to this information until it gets posted somewhere online or a news station airs it. We have to wait, and that gives the rich a huge advantage here. You can’t beat them trading, you have to beat them strategically.

The hedge fund managers also have the ability to go on CNBC and promote the stocks they just bought. The viewers, regular investors like you and I, wanting to make money go and buy those stocks. Then magically, that company’s shares go up 5% while the person is still on live TV. What WSB does is no different than what these hypocrites do. Members post their trades and provide the reasons for doing so. Followers decide whether the information is valid and if the reasons are sustained, they join the trade looking to make money. It’s the exact the same thing, but the difference is the hot shots are losing money, and that’s a big no-no.

Regardless, the same talking points continued through the weekend and into early this week. Wallstreetbets is bad, members are gambling, blah, blah, blah. The sub, however, was invigorated. They continued their revolt and continued buying, triggering the short squeeze of all short squeezes. The price of GameStop rose to nearly $500 yesterday. That’s a nearly 2,700% increase. That equates to serious losses for the shorters, and some life changing money for the “amateurs”. DeepFuckingValue was up to nearly $50 million this morning. Both Citron and Melvin Capital admitted defeat, and closed their shorts yesterday (though members of WSB have filed suit claiming that this was a blatant lie as the research shows the amount of shares still shorted at the time of the CNBC interview did not match either funds filings).

With the success of GameStop, other members of WSB saw further opportunity. They researched other companies whose stock was being heavily shorted and began providing their research to the public forum. Members looking for possibilities of short squeezes piled into trades. AMC, the movie theater chain, rose 480%. Koss Corporation, a headphones company, rose 3,600%. Express, the clothing company, rose 680%. Nokia, the phone company, rose 134%.

They exposed a flaw in the system and made significant money from it. So, what’s next for WSB? Right now, nothing. Wall Street and the brokerages have banned trading on certain high risk stocks. Yes, that is real. Robinhood and other brokerages are actively preventing the average investor from making money on systemic flaws. You can only sell those stocks on the platforms. Meaning the shorts are being helped by these brokerages. Ridiculous! The rich have exposed these flaws for millennia, pumping and dumping stocks at will, but god forbid the people make money. WSB is already in the process of filing a Class Action Lawsuit against Robinhood. Like I said, these people are smarter than they are given credit for.

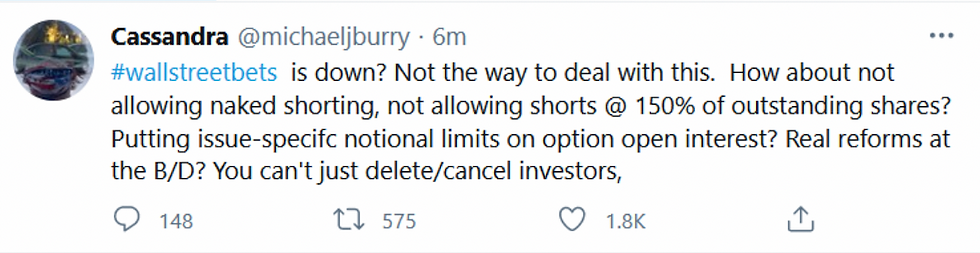

Here are some tweets in support of WSB:

As you can see, many people are behind Wallstreetbets, including some well known investors, public figures and politicians. Some of the names include Mark Cuban, Dave Portnoy and Alexandra Ocasio-Cortez. But my personal favorite was Chamath Palihapitiya's interview on CNBC. He was knowledgeable, defended WSB perfectly and completely refuted the false claims of the show's host. So much so, that CNBC has not uploaded the full interview and struck copyright claims across YouTube.

Times are changing. This is not the time to back down. Wall Street has resorted to cheating. We must be smart and strategic. Keep the DD coming people!

And the shitposts too, I love a good laugh. I'll leave you with my favorite on GameStop - Tendieman.

Comments